Depreciation tax shield formula

March 25 2022 blog Sumit If you had to spend 9000 to get the tax shield formula you wouldnt want to pay for it. In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense.

Depreciation Tax Shield Formula And Calculator Excel Template

Many people that are working or looking for work in these two industries.

. Double-Declining Method Depreciation Double-Declining Depreciation Formula To implement the double-declining depreciation formula for an Asset you need to know the assets. The maximum depreciation expense it can write off this year is 25000. The tax shield computation is represented by the formula above.

Depreciation or CCA tax shield depreciation or CCA amount x. Determine the total depreciation value that can be considered in the deduction. DA is embedded within a companys cost of goods.

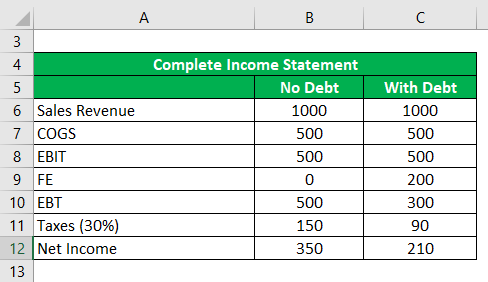

Depreciation Tax Shield Formula. First determine the total depreciation amount. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

Will receive as a result of a. Another way depreciation tax shield can be used to reduce taxes payable is to use the accelerated depreciation tax shield technique. For this example we will assume its.

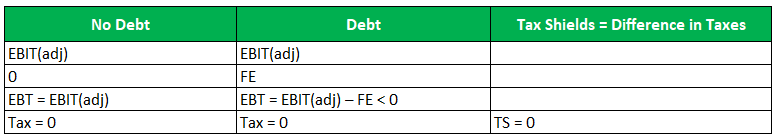

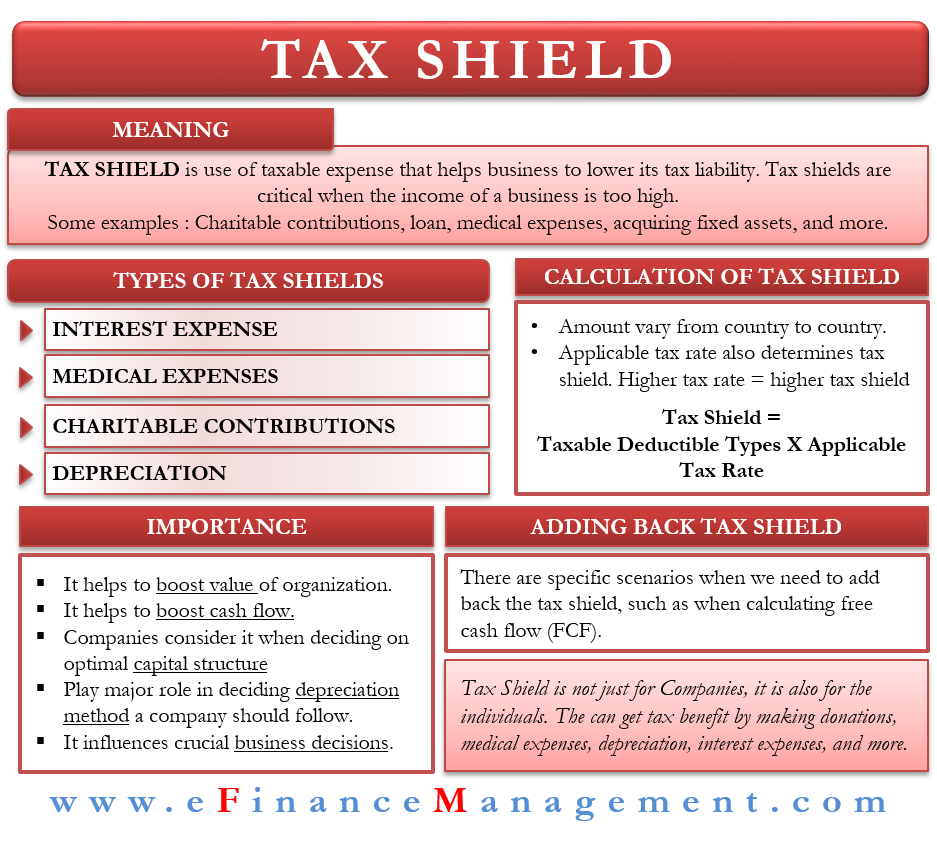

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Along with which it predicts the particular. A tax shield formula determines the future tax saving attribute of tax by showcasing an organisations present value.

Depreciation tax shield formula. Depreciation tax shield calculator. This is equivalent to the 800000.

The formula for calculating a depreciation tax shield is easy. When a company purchased a tangible asset they are able to. Any expense that lowers ie.

Depreciation is considered a tax shield because depreciation expense reduces the companys taxable income. The tax shield Johnson Industries Inc. Related tax shields come in the form of mortgage interest expense potential business expenses and depreciation.

Depreciation Tax Shield Formula. These assets continue to be a part of the balance sheet unless they are sold or destroyed. As such the shield is 8000000 x 10 x 35 280000.

The Depreciation Tax Shield reflects the Tax Savings from the Depreciation Expense deduction. Depreciation is the normal wear and tear in the asset of the organization. Shields taxes paid is a Tax Shield.

Calculate the amount of Depreciation to be debited to the profit and loss account. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective. With this method the company or taxpayer.

The Depreciation Tax Shield is a key component of financial and accounting industry strategies. It implies that the entire depreciation has been provided in the accumulated depreciation account. The applicable tax rate is 37.

By subtracting the depreciation tax shield amount from the revenue you will get an. After-tax benefit or cash inflow calculator. Basically the company uses two main tax shield strategies.

The tax shield is a device. Examples Of Depreciation Tax Shield. The impact of adding removing a tax.

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Accumulated Depreciation Definition Formula Calculation

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula How To Calculate Tax Shield With Example